Vehicle Mileage Rate 2024 Nz. Mileage rate 2024 ird nz. New vehicle mileage rates you should know.

Mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. In accordance with s de 12 (4) the commissioner is required to set and publish kilometre.

The Rates Set Out Below Apply For The 2023/2024 Income Year For Business Motor Vehicle Expenditure Claims.

The proposed changes include increasing motor vehicle licensing fees by $25 in january next year, and a further $25 in january 2026, meaning it would ultimately cost an extra.

The 2023/2024 Kilometre Rates Have Been Published.

If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2023 year, being.

Vehicle Mileage Rate 2024 Nz Images References :

Source: teddiqromola.pages.dev

Source: teddiqromola.pages.dev

Ird Mileage Rate 2024 Nz Del Gratiana, The claim will be limited to 25% of the vehicle running costs as a business expense. If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2023 year, being.

Source: nickiewania.pages.dev

Source: nickiewania.pages.dev

Irs Standard Mileage Rate 2024 Nora Thelma, The tier 1 rate is a combination of your vehicle's fixed and running costs. Expectations increase for a 2024 rate cut.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Use our kilometre rates to calculate the deduction for costs and depreciation. Ird mileage rate 2024 nz del gratiana, use the tier 1 rate for the business portion of the first 14,000 kilometres travelled by the vehicle in a year.

Source: sayreqamelina.pages.dev

Source: sayreqamelina.pages.dev

Current Business Mileage Rate 2024 Tybie Scarlet, These operational statements provide further information on the use of the kilometre rates: Motor vehicle mileage rates is a topic which catches people’s interest.

Source: gomechanic.in

Source: gomechanic.in

10 Best Mileage (Most Fuel Efficient) Petrol Cars 2021 Edition, Motor vehicle mileage rates is a topic which catches people’s interest. If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2023 year, being.

Source: www.score.org

Source: www.score.org

2023 Mileage Rates Announced by the IRS SCORE, Make sure you’re claiming the right rate! Current irs mileage rate 2024 projection mandi leoline, the rates set out below apply for the 2023/2024 income year for business motor vehicle expenditure claims.

Source: www.pbktax.com

Source: www.pbktax.com

IRS Announces Standard Mileage Rate Change Effective July 1, 2022, The rates set out below apply for the 2023/2024 income year for business motor vehicle expenditure claims. The rates are $1.04 for petrol, diesel, hybrid and.

Source: www.koamnewsnow.com

Source: www.koamnewsnow.com

IRS increases mileage rate for remainder of 2022 Local News, The rates are $1.04 for petrol, diesel, hybrid and. Use the rates for the year you’re claiming.

Source: ingeqgeorgetta.pages.dev

Source: ingeqgeorgetta.pages.dev

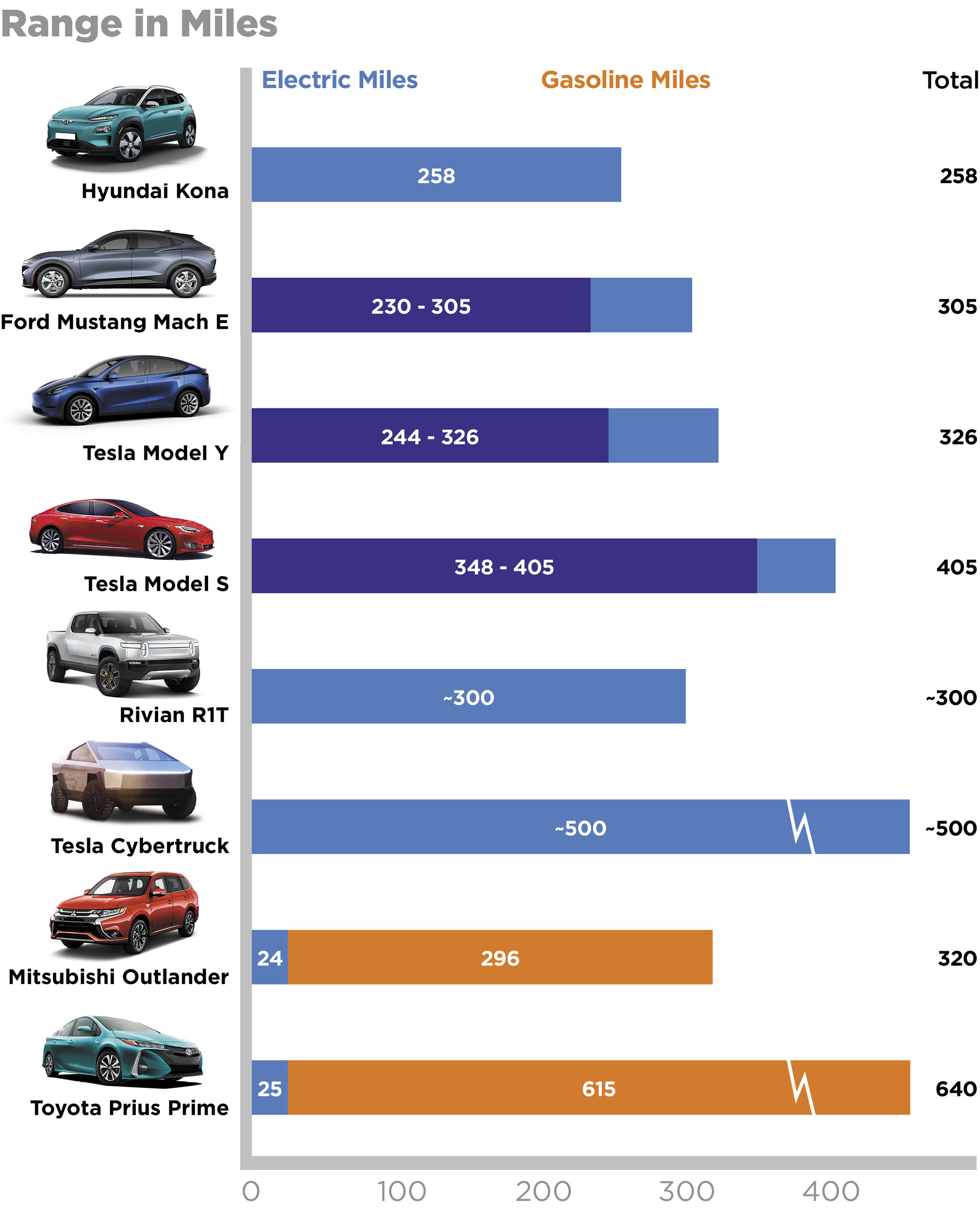

Gm Electric Vehicles 2024 Price Comparison Hazel Florentia, The 2024 income year rates. The 2023/2024 kilometre rates have been published.

Source: nypa.evnavigator.com

Source: nypa.evnavigator.com

BEV and PHEV Ranges, The tier one rates reflect an overall increase in. Inland revenue has advised the new mileage rate for motor vehicles is 77 cents per kilometre.

Our Team Of Aa Experts Can Give You Advice On Running Costs Like Fuel, Depreciation &Amp; Tyres And How To Reduce These Car Ownership Costs.

Ird mileage rate 2024 nz del gratiana, use the tier 1 rate for the business portion of the first 14,000 kilometres travelled by the vehicle in a year.

Expectations Increase For A 2024 Rate Cut.

The proposed changes include increasing motor vehicle licensing fees by $25 in january next year, and a further $25 in january 2026, meaning it would ultimately cost an extra.